Each year, the aviation industry consumes a large amount of fossil fuel; in order to effectively reduce greenhouse gasses by carbon offsetting in the long term, we have to reduce aviation dependence on traditional jet fuels. In this Article, Azzara’s expert has reviewed the global challenges ahead of the Sustainable Aviation Fuel Market and the critical cost components of Sustainable Fuel.

The development and demand for Sustainable Aviation Fuels (SAF) all around the globe have led to the advancement of biofuels in aviation industries. However, some challenges limit this commercial appetite for biofuels, and on top of this list is the cost of biofuels compared to conventional jet fuels. A gallon of SAF is often 40-50% more expensive compared to fossil jet fuels.

As the production pathways for SAF are still young and are nowhere as efficient as conventional fuel, that price divide is apparent. But we find that the refining costs of the fuels are not entirely the reason for the divide. On the other hand, the feedstock and fuel transportation costs are equally high.

SAF Main Markets: North America and Europe

Understanding SAF markets in air transport industries is an essential step in determining the main components of the fuel costs dividends.

The North American markets are driven by regional market-based mechanisms such as the Oregon Clean Fuels Program, California Low Carbon Fuels Program, and Canadian Clean Fuels Regulation. These programs create tradable credits by generating low-carbon fuels that fossil fuel suppliers purchase for greenhouse gas emission compliance.

Whereas, across the pond, the demand in the European market is primarily driven by legal mandate. The ReFuel EU Aviation Initiative proposes that starting in 2025, SAF takes up 2% of all aviation fuel made available to airports, increasing to 5% by 2030, 32% by 2040, and 63% by 2050. Additionally, there is a sub-mandate for synthetic aviation fuels starting with 0.7% in 2030, increasing to 8% by 2040 and 28% in 2050.

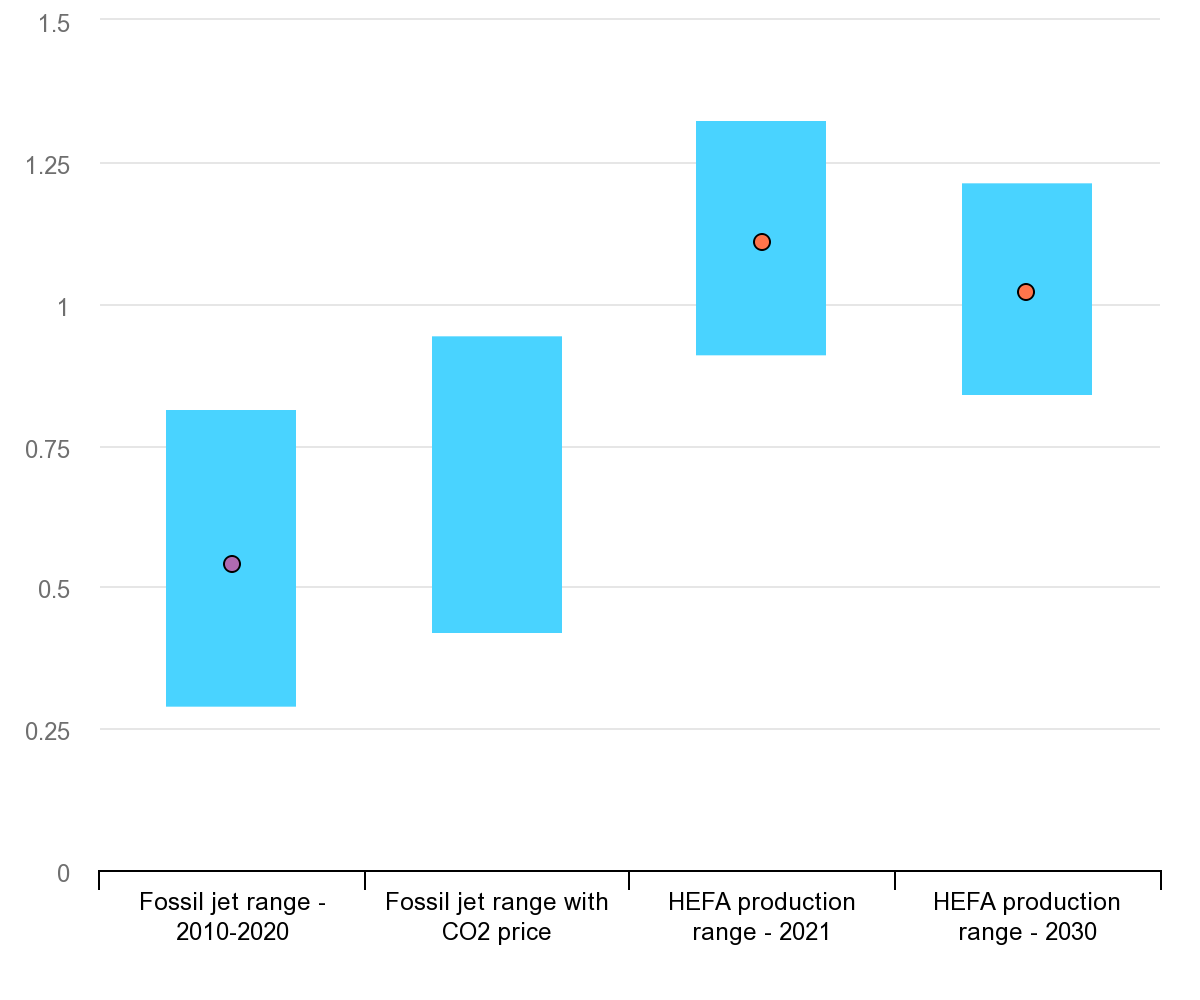

Figure: Fossil jet and bio jet fuel production cost ranges ($ per litre), 2010-2030 (Source: IEA); HEFA or SAF production costs in 2021 are about 48% of the final cost of fuel (about 2.5 USD per litre in EU)

The market-based incentive in the United States and Canada has led to a faster deployment of biofuels with additional help from repurposed refineries.

1- The Competition for Feedstock

At this time, Road transportation takes up a large portion of liquid biofuels. And this demand is met with used cooking oil (UCO). Furthermore, SAF production uses the same feedstock through a pathway known as Hydro-Processed Esters & Fatty Acids (HEFA), the least expensive path.

With the slow advancement of synthetic biofuel to production, the redirection of feedstock toward aviation fuels creates added competition and incremental barriers to feedstock accessibility which can last post-2030.

There are, of course, other promising feedstock sources, such as algae, which have a fast bloom cycle but are still at the early stages of development.

2- The cost of transportation

Over 50% of the demand for aviation fuel in Europe is from only ten airports. Providing SAF at the existing low blending volumes for these airports requires multiple trips. Hence reducing the effects of emission reduction with the additional supply chain emissions.

In addition, the highest blending volume for a SAF pathway at present is 50%. However, the cost pressure of the fuel is leading to even lower end-user blending rates of about 0.5% to 1%. The perfect solution would be to deliver SAF from pipelines into central hubs, but we’re not there yet.

3- Limited SAF Production Centres

With Neste, ENI and BP being the only three major Sustainable Aviation Fuel Producers in Europe, SAF production can not meet the demand of traditional jet fuel users. Neste corporation operates its largest SAF production facility in Rotterdam. Just a few days ago, they announced refinery expansion and doubling of their SAF capacity to 1.2 million tonnes by the end of 2023. Their total capacity for renewable products could then be 2.7 million tonnes annually.

Several others have laid out plans for SAF production between 2024-2026. Shell is expected to start producing SAF at its Rotterdam plant beginning in 2024 and with a capacity of 500 thousand tonnes annually. Shell aims to reduce the production of traditional fuels by 55% by 2030 and provide more low-carbon fuels such as biofuels for road transport and aviation.

If the feedstock availability continues, the added competition in the decade’s second half is expected to drive down SAF costs. New technologies will continue to open more energy-efficient pathways in SAF production.

In Conclusion

With the current share of the fuel costs in airline operating costs at roughly %25, these hidden costs will eventually decide the success of SAF in decarbonizing aviation. And for the mom